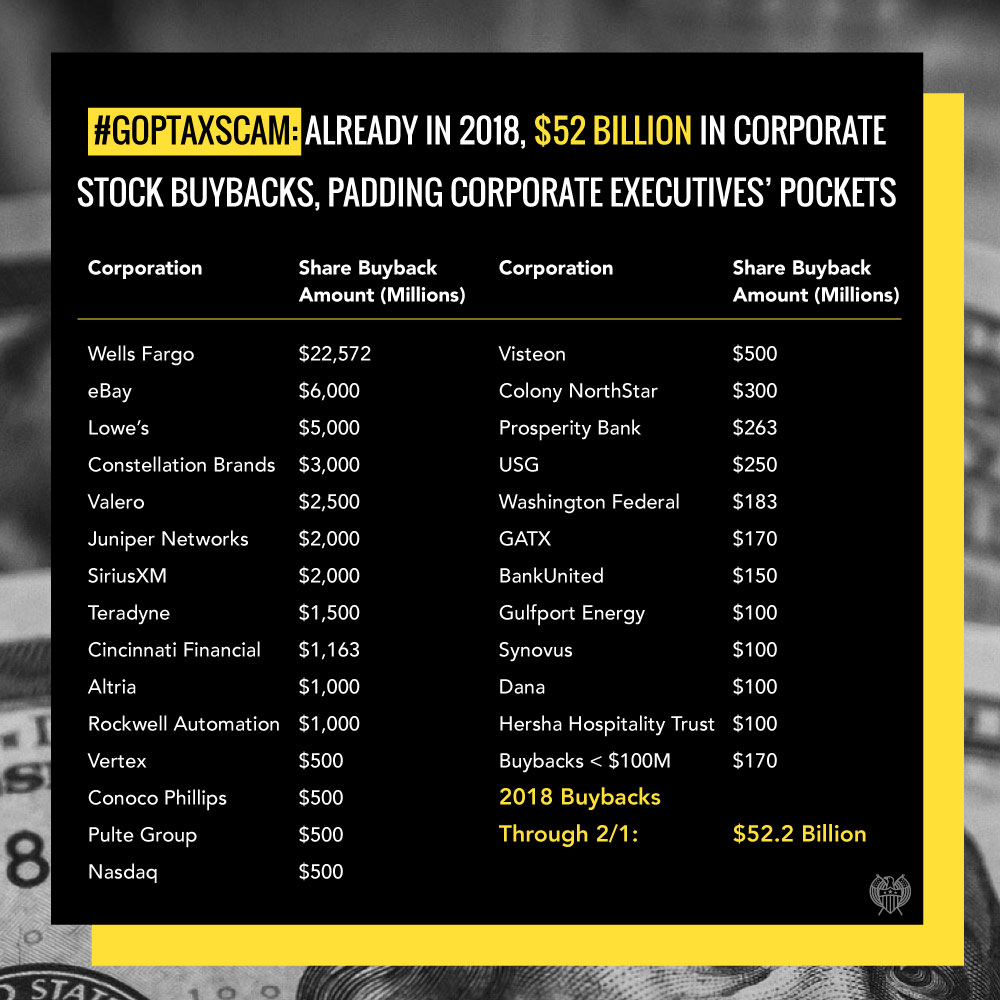

In Wake of Republicans’ Massive Corporate Tax Giveaway, Corporations Have Laid Off Thousands of American Workers, Lined Corporate Executives’ Pockets with More than $50 Billion in Announced Share Buybacks in First Days of 2018

In the wake of Republicans’ massive corporate tax giveaways, big banks, oil and tobacco companies, and other corporations have announced more than $50 billion on stock buybacks in the first days of 2018. These buybacks flow directly to the pockets of corporate executives – not American workers. Since the Senate Republican tax bill passed in December, corporations have authorized $136 billion on corporate share buybacks. Big Corporations have pocketed their windfalls and laid off American workers. As one economics professor told the Financial Times this week, “The only benefit of share buybacks is to people who are in the business of selling shares: executives.”

MAJOR CORPORATIONS HAVE POCKETED BILLIONS FROM STOCK BUYBACKS AND LAID OFF WORKERS – ALL WHILE TRYING TO GET GOOD PRESS FROM THE REPUBLICAN TAX BILL

Financial Times: Wells Fargo Plans To Close 900 Branches Despite $3.4bn Tax Boost. “Wells Fargo plans to close about 900 branches as part of efforts to cut costs in the wake of its mis-selling scandal even though the bank’s profits received an immediate $3.4bn boost from the US corporate tax cut. Executives at the San Francisco-based group, which operates about 5,860 branches across the country, said on Friday they would make the closures to the retail network by the end of 2020 — including at least 250 this year. The disclosure came even though Wells is set to be among the biggest beneficiaries of the tax cuts among the country’s largest banks and last month said it would boost the staff minimum wage and hand 250,000 employees restricted stock awards.” [Financial Times, 1/12/18]

MarketWatch: Wal-Mart Has Announced Thousands Of Layoffs Since Publicizing Bonuses And Benefits Expansion. “Since Wal-Mart Stores Inc. announced it would hand out bonuses and expand benefits to more than 1 million associates thanks to new tax reform measures, the retail giant has also laid out plans for store closures and thousands of layoffs at both the store and corporate level. Wal-Mart confirmed about 1,000 layoffs in California on Monday, including 650 associates in Sam’s Club locations in Los Angeles, Sacramento and Orange County, and 359 at a Wal-Mart location in Sacramento.” [MarketWatch, Updated 2/1/18]

USA Today: Kleenex, Huggies Maker To Cut Up To 5,500 Jobs, Close 10 Plants. “Kimberly-Clark, which also produces Huggies diapers, Kotex feminine hygiene products, Cottonelle toilet paper and Scott paper towels, plans to cut up to 5,500 jobs and close or sell about 10 plants. The Dallas-based company blamed sluggish sales and a bloated production base.” … “Savings from the recent federal tax cut would help fund the cost reductions. It ‘provides us the flexibility’ to do so, Chief Financial Officer Maria Henry said on a conference call.” [USA Today, 1/23/18]

Indianapolis Star: AT&T, Touting Bonuses And Investment Fueled By Tax Reform, Quietly Lays Off Thousands. “When AT&T Inc. announced it would hand out holiday bonuses to 200,000 workers thanks to Congress' recent tax overhaul, the company's statement failed to mention a separate, yet notable, personnel matter: Many employees will be getting laid off in the coming weeks. AT&T is eliminating thousands of jobs across the U.S., including 30 in Central Indiana, according to Communications Workers of America, the union that represents AT&T employees.” [Indianapolis Star, 1/2/18]

Newsweek: Comcast Fired Hundreds Of Workers Before Christmas Alongside Pledge To Give $1,000 'Trump Tax Cut' Bonuses. “Just two weeks before Christmas, hundreds of Comcast door-to-door salespeople were called into company offices and fired from their jobs, it has emerged, just after the telecommunications giant announced it would be giving out $1,000 bonuses to staffers thanks to a major tax cut.” [Newsweek, 1/5/18]