As Millions More Americans See No Refund This Tax Season, Corporate Executives And Wealthy Shareholders Continue To Cash In On Republican Tax Law Via Record Stock Buybacks

President Trump promised the Republican tax law would be a “middle-class miracle” – instead, millions fewer Americans are set to receive tax refunds, while up to 30 million taxpayers could face additional penalties from the IRS because of the new tax law. As millions of American families struggle to get by, corporate executives and wealthy shareholders have cashed in through record corporate stock buybacks since the Republican tax law was enacted. Unfortunately, many of those same corporations who have announced billions in corporate stock buybacks have also laid off American workers while still reaping the benefits of the tax law.

The facts are clear: the Republican tax bill was sold as “rocket fuel” for the economy and a boon to the middle class – instead, the vast majority of the benefits have gone to corporations and the wealthiest few. It’s no wonder that according to recent polls, the American people know the tax law benefits corporations and the wealthy – not the middle-class.

CORPORATE EXECUTIVES CASHED IN ON RECORD STOCK BUYBACKS IN 2018 – AND NOW THEY ARE SETTING NEW RECORDS WITH HUNDREDS OF BILLIONS IN AUTHORIZED SPENDING ON BUYBACKS IN THE FIRST MONTHS OF 2019

AP: U.S. Companies’ Tax Windfall Fuels Record Share Buybacks. “U.S. corporations spent a record amount buying back their own shares last year, using 2017?s tax-cut windfall to reward shareholders rather than to invest or expand their businesses. Companies in the S&P 500 spent $806 billion on stock buybacks in 2018, blowing away the previous record of nearly $590 billion set in 2007.” [AP, 4/4/19]

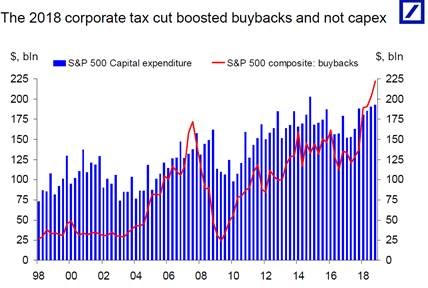

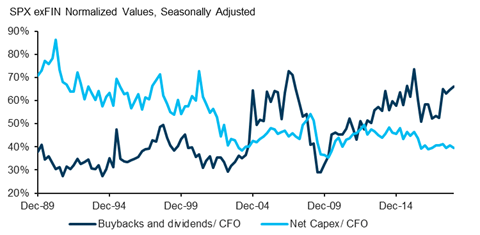

Axios: Stock Buyback Binge: 2019 Is Setting A Record Pace. “U.S. companies are on pace to buy back more of their shares than they did during 2018's record binge, data shows, despite — or perhaps because of — mounting political opposition.” … “Companies are continuing to choose buying back their stock to reduce the number of shares outstanding and boost prices over investing in long-term capital and labor expenditures. Last year, companies spent more buying back their own stock than on capex for the first time since 2008, according to Citigroup.” [Axios, 3/29/19]

CORPORATIONS HAVE ALREADY ANNOUNCED MORE THAN $200 BILLION IN NEW CORPORATE STOCK BUYBACK PLANS IN 2019, MAKING IT ONE OF THE TOP QUARTERS EVER - MEANWHILE, MANY OF THOSE SAME COMPANIES ARE LAYING OFF AMERICAN WORKERS

According to the investment research firm TrimTabs, corporations have already announced $213 billion in new corporate stock buyback plans in 2019. Unfortunately, many of those companies have announced billions in corporate stock buyback plans while also laying off American workers.

- eBay announced plans to lay off workers in 2019. eBay also announced it will reward corporate executives and wealthy shareholders with an additional $4 billion increase in its corporate stock buyback program.

- Ball Corporation announced plans to lay off workers in Texas. In 2019, Ball Corporation announced it will reward corporate executives and wealthy shareholders with billions of dollars through a corporate stock buyback program.

- Activision Blizzard announced plans to lay off hundreds of workers in 2019. Activision Blizzard also announced it will reward corporate executives and wealthy shareholders with a $1.5 billion corporate stock buyback program.

- Xerox announced plans to lay off more workers after already laying off hundreds. In 2019, Xerox also announced it will reward corporate executives and wealthy shareholders with a $1 billion corporate stock buyback program.

- Oracle announced plans to lay off hundreds of workers in California. Oracle also spent nearly $30 billion on corporate stock buybacks in the nine months ending on February 28, 2019.

WHILE CORPORATE STOCK BUYBACKS BOOMED IN THE FIRST YEAR AFTER THE REPUBLICAN TAX LAW WAS ENACTED, CAPITAL EXPENDITURES DID NOT COME CLOSE TO MATCHING THAT PACE

Republicans said that their tax law would cause “massive investment” in the United States. That investment was supposed to trickle down and benefit American workers. However, one of the largest forms of corporate investment, so-called capital expenditures, has not materialized at anticipated levels; as corporate stock buybacks have surged to record highs, capital expenditures have failed to keep pace.

President Donald Trump: “Finally, our tax plan will return trillions of dollars in wealth to our shores so that companies can invest in America again.” [Remarks by President Trump Before Cabinet Meeting, 11/20/17]

Treasury Secretary Steve Mnuchin: “I do think fundamentally, this has been a game changer for U.S. businesses. You’re going to see massive investment coming back into the U.S. As the president said, we were with many CEOs last night that said as soon as the tax plan was changed, they’re moving operations to the U.S., to build things for the U.S. market., I may add. Which makes them more efficient in employing U.S. workers.” [CNBC, 1/26/18]

Source: Deutsche Bank via Business Insider

Source: Barclay’s via MarketWatch

###