NEW VIDEO: Republicans Admit: Middle Class Americans Would See Tax Hike Under GOP Tax Plan

GOP Openly Admit Middle Class Americans, Particularly Those In High Tax States Like NY, NJ, & CA, Could Actually See A Tax Increase Rather Than Tax Relief Under Republican Bill GOP Plan Gives Massive Tax Breaks To Special Interests And Large Corporations On The Backs Of Middle Income Taxpayers, Who Could Pay More Under GOP Plan Senate Dems: Tax Cuts For Special Interests And Tax Hikes For Working People Is Not The Tax Plan Middle Class Americans Signed Up For

Washington, D.C. – Since unveiling their tax proposal, Republicans have openly admitted that middle class Americans could see tax hikes rather than tax relief under the GOP tax plan. While the GOP plan gives massive tax breaks to special interests and large corporations, Republicans admit that they aim to do so on the backs of hardworking people. Senate Democrats today said any plan that increases taxes on middle income people in order to give special interests and corporations massive tax cuts will be met dead on arrival with the American people.

Click here to view the video on Facebook.

Click here to view the video on Twitter.

House Majority Leader Kevin McCarthy (R-CA):

HEMMER: Will this proposal raise taxes on anyone, middle class, upper income, any American?

MCCARTHY: Yeah, some Americans probably will. [Fox News, 10/31/17]

House Budget Committee Chairman Diane Black (R-TN): “You know, there is a potential for some of those states that have very high SALT taxes, state and local taxes, to see a little bit of an increase in their taxes.” [Fox News, 11/4/17]

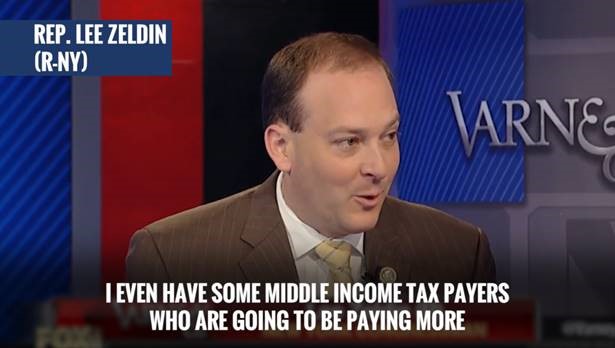

Rep. Lee Zeldin (R-NY): “I even have some middle income taxpayers who are going to be paying more than if we just kept the current law as it is.” [Fox Business News, 11/3/17]

Sen. Ted Cruz (R-TX): “But there are some taxpayers who are losing exemptions, particularly in some high tax states, like New York or California, that could conceivably be paying higher taxes. I think that is a mistake.” [Press Conference, 11/7/17]

Rep. Dan Donovan (R-NY): “And the elimination of some that deductions that the people I represent depend on, allows them to buy homes, allows them to deduct their medical expenses, allows them to deduct their mortgage interest. The elimination of these things are very harmful to the people that I represent.” [Fox Business, 11/3/17]

Rep. Peter King (R-NY): “But this particular tax bill, by taking away the state and local tax deduction has a particularly devastating effect on New York and New Jersey. … And it would have an extremely damaging effect on my constituents who are middle, in some cases upper middle, but mostly middle income. … And the main objection I'm getting in my district are from Trump voters. [ABC This Week, 11/5/17]