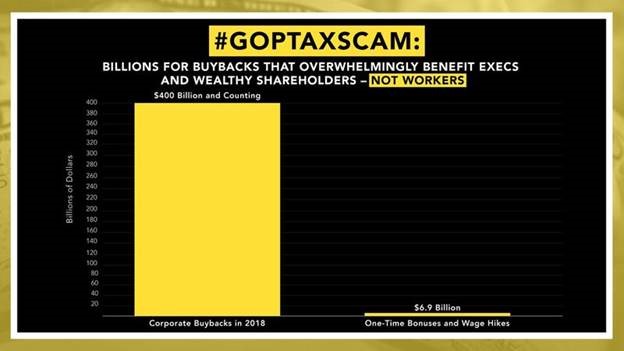

The #GOPTaxScam For The Rich Has Now Delivered $400 Billion In Stock Buybacks To Wealthy Shareholders And Corporate Executives, But Fails To Deliver For Middle-Class Americans

WSJ: “Goldman Sachs expects S&P 500 companies’ spending on buybacks and dividends to increase by 22% to $1.2 trillion in 2018, outpacing the expected increase in capital expenditures and R&D in 2018”

Politico Pro: “while Republicans see lots of evidence of the law's impact, people who monitor economic indicators say the changes have barely begun to register”

TrimTabs: ” U.S. companies are spending much more on cash mergers and stock buybacks than they are on hiring and pay increasings, benefiting top management and investors far more than the average worker

Republicans promised that the GOP Tax Scam for the rich would be a middle-class miracle – instead, it’s a giveaway to the wealthiest corporations. Less than halfway into 2018, corporations have announced more than $400 billion in corporate stock buybacks, which overwhelmingly benefit corporate executives and wealthy shareholders. In fact, 84% of stocks are owned by the top ten percent of Americans. Far too many corporations are rewarding the wealthy through buybacks while laying off American workers.

“From my Republican colleague to President Trump’s former advisors and the millions of Americans struggling to get by, everyone agrees that the tax law has failed the middle class,” said Finance Committee Ranking Member Ron Wyden (D-OR). “For months we’ve watched corporations purchase a record-breaking amount of stock buybacks, which fatted the accounts of wealthy shareholders both here at home and overseas. We’ve also watched President Trump fail to deliver $4,000 wage increases to working Americans. Meanwhile, new reports show that average CEO pay has reached a $12-million-dollar high. This law is about as one-sided as it gets, with no signs that handouts for the wealthy and broken promises for the middle class are going to slow down.”

|

Corporation |

Share Buyback Amount Announced in 2018 (Billions) |

Date |

|

$100 |

1-May |

|

|

$25 |

14-Feb |

|

|

$22.6 |

23-Jan |

|

|

$15 |

13-Feb |

|

|

$12 |

12-Apr |

|

|

$12 |

1-Feb |

|

|

$10 |

15-Feb |

|

|

$10 |

1-Feb |

|

|

$9 |

25-Apr |

|

|

$8.8 |

9-May |

|

|

$8.6 |

1-Feb |

|

|

$8 |

27-Feb |

|

|

$7.5 |

1-Feb |

|

|

$6 |

14-Feb |

|

|

$6 |

31-Jan |

|

|

$6 |

1-Feb |

|

|

$6 |

26-Apr |

|

|

$5 |

30-Apr |

|

|

$5 |

14-Feb |

|

|

$5 |

26-Jan |

|

|

$4 |

5-Apr |

|

|

$3.5 |

12-Feb |

|

|

$3.3 |

14-Feb |

|

|

$3 |

28-Feb |

|

|

$3 |

5-Jan |

|

|

$3 |

24-Apr |

|

|

$2.8 |

27-Feb |

|

|

$2.7 |

12-Apr |

|

|

$2.56 |

18-Apr |

|

|

$2.5 |

23-Jan |

|

|

$2.4 |

8-May |

|

|

$2 |

25-Apr |

|

|

$2 |

25-Apr |

|

|

$2 |

19-Mar |

|

|

$2 |

6-Mar |

|

|

$2 |

6-Feb |

|

|

$2 |

30-Jan |

|

|

$2 |

23-Jan |

|

|

$1.5 |

20-Feb |

|

|

$1.5 |

14-Feb |

|

|

$1.5 |

24-Jan |

|

|

$1.3 |

22-Feb |

|

|

$1.25 |

18-Apr |

|

|

$1.25 |

9-Apr |

|

|

$1.25 |

28-Feb |

|

|

$1.2 |

20-Apr |

|

|

$1.2 |

26-Jan |

|

|

$1.1 |

26-Apr |

|

|

$1 |

9-May |

|

|

$1 |

25-Apr |

|

|

$1 |

24-Apr |

|

|

$1 |

18-Apr |

|

|

$1 |

20-Mar |

|

|

$1 |

15-Mar |

|

|

$1 |

8-Mar |

|

|

$1 |

7-Mar |

|

|

$1 |

1-Mar |

|

|

$1 |

8-Feb |

|

|

$1 |

7-Feb |

|

|

$1 |

5-Feb |

|

|

$1 |

1-Feb |

|

|

$1 |

25-Jan |

|

|

Buybacks <$1 Billion |

$46.6 |

|

|

TOTAL Corporate Buybacks Authorized in 2018 |

$408 Billion |

*Based on closing price on the day share buyback was announced.

THE GOP TAX SCAM FOR THE RICH IN ACTION: CORPORATE EXECUTIVES ARE PADDING THEIR POCKETBOOKS WITH STOCK BUYBACKS WHILE LAYING OFF AMERICAN WORKERS:

- Qualcomm announced plans to lay off 1,500 workers. Qualcomm also announced it will reward corporate executives and wealthy shareholders with an $8.8 billion share buyback program.

- Devon Energy announced plans to lay off nine percent of its workforce – about 300 workers. Devon Energy also announced it will reward corporate executives and wealthy shareholders with a $1 billion share buyback program.

- Wells Fargo announced it will close 900 branches despite a $3.4 billion boost from the Republican tax scam. Wells Fargo also announced it will reward corporate executives and wealthy shareholders with a $22 billion share buyback program.

- Kimberly-Clark announced plans to cut up to 5,500 jobs. Kimberly-Clark also announced it will reward corporate executives and wealthy shareholders with $700-$900 million in share buybacks in 2018.

- CSX announced plans to lay off thousands of workers. CSX also announced it will reward corporate executives and wealthy shareholders with a $3.5 billion increase in their share buyback program.

- Harley-Davidson is closing a Kansas City motorcycle assembly plant, resulting in 800 workers losing jobs. Harley-Davidson also announced it will reward corporate executives and wealthy shareholders with a $696 million share buyback program.

- Hess Corporation announced they will lay off hundreds of workers. Hess Corporation also announced it will reward corporate executives and wealthy shareholders with a $1 billion share buyback program.

- Cardinal Health announced it will lay off 100 workers. Cardinal Health also announced it will reward corporate executives and wealthy shareholders with a $1 billion share buyback program.

THE EVIDENCE CONTINUES TO PILE UP: REPUBLICAN TAX SCAM FOR THE RICH IS NOT WORKING AS PROMISED

WSJ: “Now with new tax incentives, share repurchases are ramping up again. The tax code overhaul President Donald Trump signed into law late last year assessed a one-time tax on foreign earnings, meant to encourage companies to repatriate more than $2 trillion in cash held overseas. While that cash can be used for any number of activities, early signs suggest that much of it is going into shareholder returns. Goldman Sachs expects S&P 500 companies’ spending on buybacks and dividends to increase by 22% to $1.2 trillion in 2018, outpacing the expected increase in capital expenditures and R&D in 2018, which it sees jumping 11% to $1 trillion.” [WSJ, 5/10/18]

Politico Pro: Economists Throw Cold Water On Bullish Tax Cut Claims. “Republicans’ eagerness to chalk up the strong economy to their recent tax-code revamp has some economists rolling their eyes.” … “But while Republicans see lots of evidence of the law's impact, people who monitor economic indicators say the changes have barely begun to register. ‘So far, we have not seen any meaningful effects of the stimulus on economic activity,’ JPMorgan said in a research note last week.” [Politico Pro, 5/9/18]

CBS Moneywatch: Guess Where The Corporate Tax Cut Money Is Flowing. “With public companies on track to shower a record $1 trillion on investors through dividend increases and share buybacks, Sen. Marco Rubio's recent suggestion that workers weren't getting much benefit from corporate tax cuts may sound truer than ever… The GOP tax law drastically cut taxes on U.S. businesses, slashing the corporate rate to 21 percent from 35 percent, yet expectations that companies would increase their investments in labor or business expansions are not panning out. At least not in contrast to the rewards being heaped upon investors. For the current quarter, ‘buybacks are expected to increase, potentially setting a new record for the year, with total shareholder return [of buybacks and dividends for the S&P 500] topping $1 trillion for the first time,’ Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, wrote Monday. Rubio's take is ‘basically correct,’ David Santschi, director of liquidity research at TrimTabs Investment Research, told CBS MoneyWatch. Winston Chua, an analyst at TrimTabs, added that ‘U.S. companies are spending much more on cash mergers and stock buybacks than they are on hiring and pay increasings, benefiting top management and investors far more than the average worker.’” [CBS, 5/2/18]

CNBC: Companies To Return A Record $1 Trillion To Investors This Year In Form Of Buybacks And Dividends, Estimates S&P. “Publicly traded companies in the U.S. could do something they have never done before. Through the end of April, S&P 500 companies are on track to give back a record $1 trillion to investors through dividend increases and stock buybacks, according to data compiled by Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. … In the note, he pointed out that 169 S&P 500 members hiked their dividends in the first four months of the year, while no company in the index cut its dividend. That's ‘an event not seen since at least 2003 (when my records begin),’ Silverblatt said. He also said, citing initial reports, that buybacks ‘produced an outrageous 72% gain due to a few significant issue level increases, but even excluding those buybacks they are up between 25% and 42% depending on the exclusions.’” [CNBC, 5/1/18]

New York Times: Investment Boom From Trump’s Tax Cut Has Yet to Appear. “After years of costly layoffs and plant closings, things are looking up for the heavy-machinery giant Caterpillar, which forecasts solid global sales growth and increased demand this year. Yet despite the corporate investment incentives at the center of President Trump’s tax overhaul, the company’s executives have no plans to supercharge investment or expansion. Caterpillar’s plans for new investment remain low by historical standards. Instead, the company has started using cash to repurchase its own stock as a way to return cash to shareholders, something it hadn’t done since 2015. … But with roughly a quarter of the companies in the S.&P. 500 having reported first-quarter results, their spending on buybacks is even higher, up 43 percent from the first quarter of 2017, to $43 billion, according to data from Howard Silverblatt, an analyst at S&P Dow Jones Indices.” [New York Times, 4/30/18]

Business Insider: The Pay Increases That Were Supposed To Come From The Trump Tax Law Haven't Shown Up Yet. “The April jobs report, released Friday, showed a mixed outlook for the US labor market. But one number in particular stood out as a glaring weak spot that could be concerning for Republicans' electoral outlook later this year. According to the report, average hourly earnings increased just 0.1% from a month ago and just 2.6% year-over-year, both short of expectations. That keeps wage growth stuck in its sub-3% growth trend, despite a historically low unemployment rate that fell below 4%. Mark Hamrick, chief economist at Bankrate, said it was proof that the promised pay boost from the Republican tax law has not shown up yet. ‘Wage growth was less-than-stellar, putting the fears seen earlier this year of possible overheating inflation on the back burner,’ Hamrick said. ‘This also disrupts the narrative on the potential benefits of the tax cut where more generous pay had essentially been promised.’ Since the GOP tax law was implemented, Republican leaders pointed to one-time bonuses and wage-hike announcements as proof of the law's benefits for middle-class Americans. Corporate earnings and share buybacks are booming, but companies' gains don't appear to have trickled down to employees — at least yet.” [Business Insider, 5/4/18]

Charlotte Observer: Large-Scale Wells Fargo Job Cuts Hit Home In This North Carolina County. “Wells Fargo is behind one of the biggest job cuts in the state in the past five years, a move that will hit a small eastern North Carolina county especially hard. In March, the San Francisco bank disclosed plans to lay off 593 workers in Pitt County in Eastern North Carolina, the latest step in a consolidation push that previously impacted Charlotte and other U.S. markets. Wells said the changes are part of adjustments to its auto-lending operations that have faced regulatory scrutiny lately. While Pitt County will see jobs vanish, the bank has said employees will be offered the chance to relocate to Raleigh or three other states. The cuts were the largest the bank has disclosed in North Carolina through a Worker Adjustment and Retraining Notification Act, or WARN, notice in the past five years, an Observer analysis found. It was also among the largest layoffs disclosed by any company in the state during that period.” [Charlotte Observer, 5/1/18]