The Trump Administration Is Using Fake Math To Push Tax Cuts for the Wealthiest Americans and Corporations

Evidence Shows A Corporate Tax Cut Benefits Those At The Top – Won’t Boost Wages Despite Administration’s Claims

Center on Budget and Policy Priorities: “The evidence indicates that most of the benefits from a corporate rate cut would go to those at the top, with only a small share flowing to low- and moderate-income families. Mainstream estimates conclude that more than one-third of the benefit of corporate rate cuts flows to the top 1 percent of Americans, and 70 percent flows to the top fifth. Corporate rate cuts could even hurt most Americans since they must eventually be paid for with other tax increases or spending cuts.” [CBPP, 10/11/17]

Professor Kimberly Clausing, Reed College: “Research shows that corporate tax cuts are far more likely to end up in the hands of those at the top of the income distribution.” [Fact Check.Org, 9/7/17]

The Consensus is Clear: The Vast Majority of the Corporate Tax Burden Falls on Corporations and Shareholders, Not Workers.

- Treasury Department Office of Tax Analysis: “In summary, 82% of the corporate income tax burden is distributed to capital income and 18% is distributed to labor income.” [Distributing the Corporate Income Tax: Revised U.S. Treasury Methodology, 5/17/12]

- James Nunns, Tax Policy Center: “The Tax Policy Center assigns 80 percent of the corporate income tax burden to capital and only 20 percent to labor (workers’ wages and fringe benefits).” [Fact Check.Org, 9/7/17]

- Congressional Budget Office: “CBO has reevaluated the research on that topic, and in this report it allocates 75 percent of the federal corporate income tax to capital income and 25 percent to labor income.” [CBO, 7/12]

- Joint Committee on Taxation: “In the long run it [JCT] distributes 75 percent of corporate income taxes and 95 percent of the taxes attributable to passthrough business income to owners of capital.” [JCT, 10/16/13]

- Congressional Research Service: “Based on these models, it appears that most of the burden of the corporate tax falls on capital. … Thus the tax is a progressive one that falls on capital incomes and thus largely on higher incomes.” [CRS, 9/22/17]

The Trump Administration Is Censoring Actual Economic Research and Using Fake Math Instead

WSJ: Treasury Removes Paper at Odds With Mnuchin’s Take on Corporate-Tax Cut’s Winners. “The Treasury Department has taken down a 2012 economic analysis that contradicts Secretary Steven Mnuchin’s argument that workers would benefit the most from a corporate income tax cut. The 2012 paper from the Office of Tax Analysis found that workers pay 18% of the corporate tax while owners of capital pay 82%. That is a breakdown in line with many economists’ views and close to estimates from the nonpartisan Joint Committee on Taxation and Congressional Budget Office. … Mark Mazur, the top Treasury tax policy official until January, said he wasn’t sure how removing the link contributed to better understanding of economics. ‘The career economists who worked on this technical paper did a great job summarizing the mainstream of economic thought on this important topic. They shifted my thinking a bit, by pointing out clearly how some of the burden gets shifted to labor,’ he said in an email on Thursday. ‘The public interest is advanced by using the best economic science available and being transparent about the analysis undertaken.’” [WSJ, 9/28/17]

The Facts are Clear: Tax Cuts that Simply Boost Corporate Profits Will Not Raise Workers’ Wages

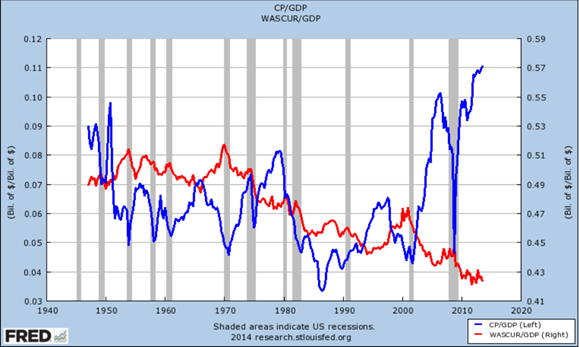

In recent years, after-tax corporate profits in recent years have been higher than at any point in the past half-century – but wages remain near an all-time low.*

(both figures as a share of GDP)*