While President Trump Travels To West Virginia To Sell the GOP Tax Scam, The Results Are Clear: Corporate Executives And Wealthy Shareholders Are Feasting On The #GOPTaxScam, And Middle-Class Workers Are Left Behind

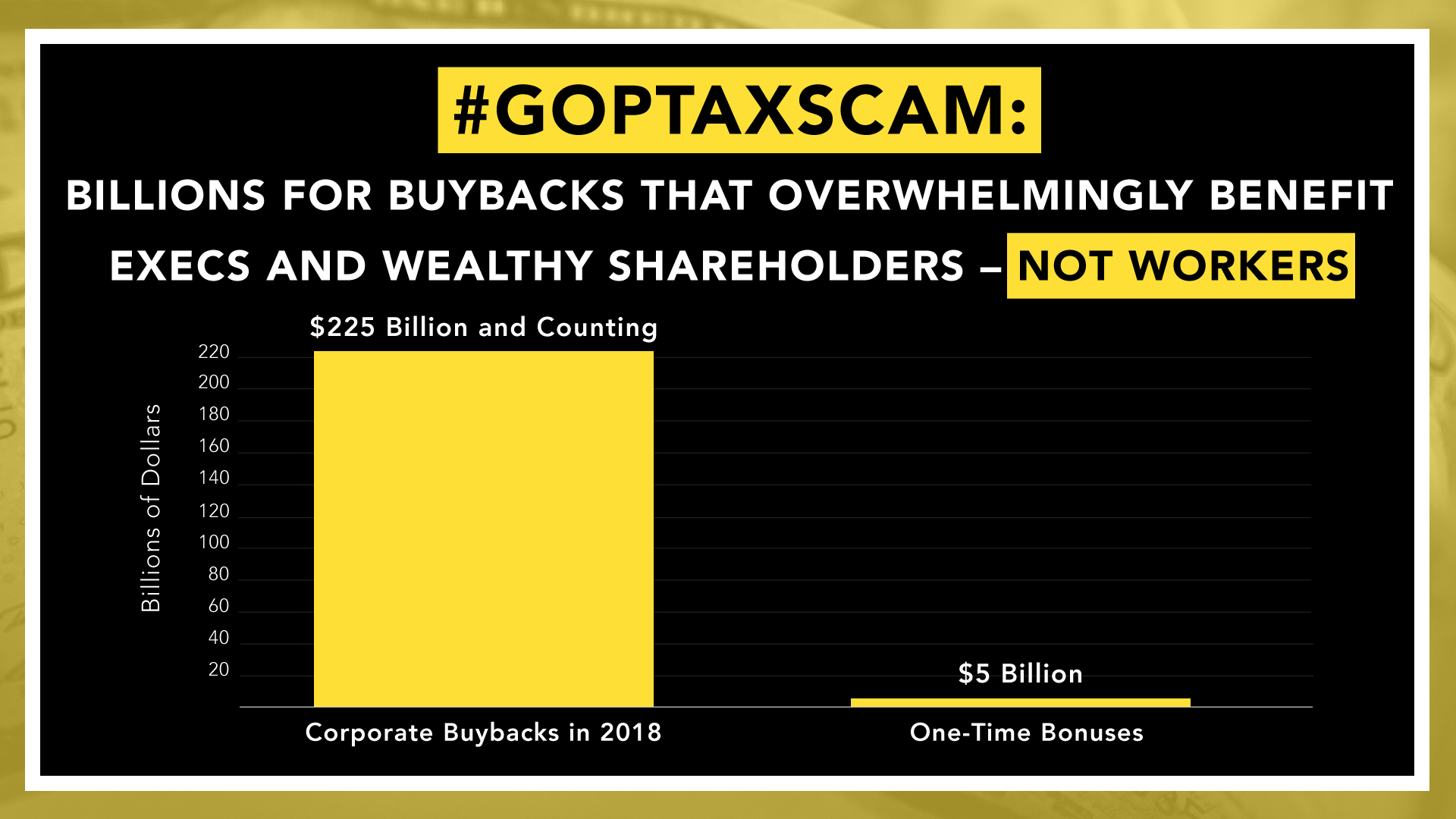

In the wake of the GOP Tax Scam, major corporations have authorized more than $225 billion in stock buyback schemes – money that overwhelmingly goes into the pockets of wealthy shareholders and corporate executives. In fact, 84% of stocks are owned by the top ten percent of Americans. These corporate buybacks overwhelmingly help corporate executives and wealthy shareholders – not workers. It’s no wonder the American people aren’t buying the GOP spin on their giveaway to corporate executives and wealthy shareholders.

WHAT THEY ARE SAYING: “GOP TAX MESSAGE HITS A SNAG” – “COMPANIES ARE PUTTING TAX SAVINGS IN THE POCKETS OF SHAREHOLDERS” – “WORKERS ARE GETTING BASICALLY NOTHING FROM THE CORPORATE TAX WINDFALL.”

Vox: Corporate Stock Buybacks Are Booming, Thanks To The Republican Tax Cuts. “Right after Republicans in Congress passed their tax bill, lowering tax rates on corporations, companies delivered a very public thank-you: a series of bonus and investment announcements. It was a major PR opportunity for both corporate America and the GOP, meant to show that American businesses were sharing their billions of dollars in tax cut savings with their workers and the broader economy. But over the next few months, the real winners from the corporate tax cut became clear — not workers and consumers, but shareholders.” [Vox, 3/22/18]

USA Today (Editorial): Corporate America Invites A Backlash. “The tax bill was sold as a way to create jobs and boost stagnant wages. So far, at least, corporations have been showing more concern about shareholders than about employees or the economy as a whole. In fact, it is hard to imagine a better strategy for fomenting a backlash and ensuring that the new low rates don't last.” [USA Today, 3/5/18]

The Hill: GOP Tax Message Hits A Snag. “Yet the CNBC poll suggested that many people aren’t noticing much of a change from the law, a sentiment that could feed into Democratic arguments that it is helping the rich while doing little for the middle class.” [The Hill, 3/30/18]

CNBC: Companies Are Putting Tax Savings In The Pockets Of Shareholders. “Share buybacks in 2018 have averaged $4.8 billion a day, double the pace for the same period last year, according to market data firm TrimTabs. That comes following Congress's move to slash the corporate tax rate from the highest-in-the-world 35 percent to 21 percent.” [CNBC, 3/12/18]

Houston Chronicle: Oil Companies To Reap Windfall In Tax Cuts, But Shareholders Get The Lion’s Share. “Houston energy companies have reported at least $20 billion in tax benefits from the recently enacted tax overhaul, but whatever savings the firms realize will likely go to well-heeled investors rather than support the local economy through hiring, pay raises and expansions. Since the Republican-controlled Congress slashed corporate rates from 35 to 21 percent at the end of last year, local energy companies have authorized billions of dollars in share buybacks and increases in quarterly dividends, joining scores of other American corporations in giving investors a bigger chunk of their profits. Economists said the trend could undercut the Trump administration’s assertion that tax cuts will directly grow employment, wages and economic activity” … “There’s still little evidence that the corporate tax benefits are finding their way to employees.” [Houston Chronicle, 3/2/18]

Huffington Post: New Tax Law Benefiting Shareholders More Than Workers So Far. “Since President Donald Trump signed the Republican tax bill in December, hundreds of retail companies have announced employee bonuses totaling more than $3 billion, which Republicans have said proves them right that the new law benefits regular Americans. But so far, companies have thrown a lot more money at their shareholders than at their workers. According to several estimates, firms have announced roughly $200 billion worth of stock buybacks this year, inflating the value of company shares by reducing their supply.’” [Huffington Post, 3/2/18]

Fast Company: Workers Are Getting Basically Nothing From The Corporate Tax Windfall. “Following last December’s corporate tax cuts, dozens of companies from AT&T to Walmart have announced bonuses and pay rises for their employees. But how much of the windfall is actually ending up in the hands of workers? The answer is less than you might think, according to an analysis of the first 105 announcements. Just Capital, which tracks corporate performance on a range of corporate responsibility-type metrics, finds that just 6% of capital allotted so far is going to staff, while 58% is going to shareholders in the form of dividends, share buy-backs, or retained earnings.” [Fast Company, 3/2/18]

Axios: Tax Cuts Will Save Health Care Companies Billions — But Not Patients. “Health care companies will add tens of billions of dollars to their bottom lines this year thanks to savings from the Republican tax cut package. But only a fraction of that money will benefit patients. Why it matters: Even though a lower corporate tax rate frees up more cash for a health care system that more patients are finding increasingly unaffordable, patients should not expect the health industry's windfall to lead to lower premiums, reduced prices or major industry changes. … Most of the money is going toward share buybacks, dividends, acquisitions and paying down debt — with just a sliver for one-time employee bonuses, research and internal investments.” [Axios, 3/5/18]

Portland Press Herald (Editorial): Companies, Shareholders Reaping Most Of The Benefits From Federal Tax Cut. “So far, the spoils of the $1.5 trillion tax cut are going exactly where Democrats opposed to the bill said they would go, right where the economic gains of the past 30 years have largely gone – to the top.” [Portland Press Herald, 3/7/18]

EXPERTS AGREE – STOCK BUYBACKS OVERWHELMINGLY BENEFIT CORPORATE EXECUTIVES AND WEALTHY SHAREHOLDERS – NOT WORKERS

David Stockman, Former Reagan Budget Director: “So we need to focus on what's wrong with the exchange rates, what's wrong with corporate America that constantly uses all of its cash flow for stock buybacks, M&A deals, LBOs, leveraged recaps. They're not investing in competitive ability for us to compete in the world market. In fact, business cap-ex in real net terms today is 30% lower than it was in the year 2000. So that's where the problem is, and this tax cut did nothing for it. It's a giant mistake that's going to drive up interest rates and cause, you know, huge windfalls to Wall Street and the 1% and 10% that own the stock. But it's not going to really address the problem.” [CNN Wolf, 3/8/18]

Robert Shiller, Professor of Economics at Yale University: Buybacks are “smoke and mirrors.” [CNN Money, 3/5/18]

Chad Leat, Former Vice Chairman of Global Banking at Citigroup: “To be clear, the beneficiary of these increasing dividends and stock buybacks are shareholders — meaning wealthy people — not hourly wage earners. If the objective of tax reform truly is to strengthen our economy and stimulate job growth, it needs to impact the 99 percent.” [The Hill, 4/3/18]

Robert Reich, Former Secretary of Labor: “Buybacks have a negative impact on inequality and on the economy.” [CNN Money, 3/5/18]

Steve Ricchiuto, Chief U.S. Economist At Mizuho Securities: “You’re not going to get the macro-economic benefit the administration thought it was going to get from its tax cuts. It’s going to go to the areas that don’t stimulate growth.” … “Share buybacks are what they are. They give the shareholders an opportunity to get the capital back and erase the value of those who don’t.” [Bloomberg, 3/2/18]

Ian Winer, Head of Equities at Wedbush Securities: “Stock buybacks are purely for the shareholder.” … “It is very difficult to argue buybacks are good for the overall economy or average worker.” [CNN (Money), 3/8/18]

Edward Wolff, Economics Professor at NYU: “The gains go disproportionately to the top,” Wolff said in an interview. Stock buybacks “will just exacerbate existing wealth inequality,” he said. [CNN Money, 3/5/18]

David Santschi, Director Of Liquidity Research at TrimTabs: “The feverish buyback activity suggests companies plan to use a hefty chunk of the money they expect to save on taxes to buy back stock." [CNBC, 3/12/18]

William Lazonick, Professor of Economics at UMass Lowell: “Stock buybacks have been a prime mode of both concentrating income among the richest households and eroding middle-class employment opportunities.” [CNN Money, 3/5/18]

Dr. Komal Sri-Kumar, President of Sri-Kumar Global Strategies: “Share buybacks are going to be positive for equity prices but they are not going to do anything for you to get a job or for your wages to go up.” [Business Insider, 2/28/18]

Christophe Moussu, Finance Professor at ESCP: “The remuneration incentive of executives based on the share price is without a doubt behind this increase in share buybacks.” [AFP, 4/4/18]

CORPORATE EXECUTIVES ARE PADDING THEIR POCKETBOOKS WITH STOCK BUYBACKS AND LAYING OFF AMERICAN WORKERS:

- Wells Fargo announced it will close 900 branches despite a $3.4 billion boost from the Republican tax scam. Wells Fargo also announced it will reward corporate executives and wealthy shareholders with a $22 billion share buyback program.

- Kimberly-Clark announced plans to cut up to 5,500 jobs. Kimberly-Clark also announced it will reward corporate executives and wealthy shareholders with $700-$900 million in share buybacks in 2018.

- CSX announced plans to lay off thousands of workers. CSX also announced it will reward corporate executives and wealthy shareholders with a $3.5 billion increase in their share buyback program.

- Harley-Davidson is closing a Kansas City motorcycle assembly plant, resulting in 800 workers losing jobs. Harley Davidson also announced it will reward corporate executives and wealthy shareholders with a $696 million share buyback program.

- Hess Corporation announced they will lay off hundreds of workers. Hess Corporation also announced it will reward corporate executives and wealthy shareholders with a $1 billion share buyback program.

- Cardinal Health announced it will lay off 100 workers. Cardinal Health also announced it will reward corporate executives and wealthy shareholders with a $1 billion share buyback program.

- Pfizer announced it will lay off hundreds of employees. In December, Pfizer announced it will reward corporate executives and wealthy shareholders with a $22 billion share buyback program.

- This year, Walmart will lay off thousands of workers. But days after Republicans introduced their tax plan outline in September, Walmart announced a new $20 billion share buyback plan to reward corporate executives and wealthy shareholders.

Record corporate share buybacks show that the GOP Tax Scam overwhelmingly benefits corporate executives and wealthy shareholders over the middle class. According to multiple analyses, corporate share buybacks are on track to be the “record highest” this year.

TO DATE, CORPORATIONS HAVE SPENT MORE THAN FORTY-FIVE TIMES AS MUCH ON BUYBACKS AS ON ONE-TIME BONUSES. See more at Democrats.Senate.Gov/GOPTaxScam