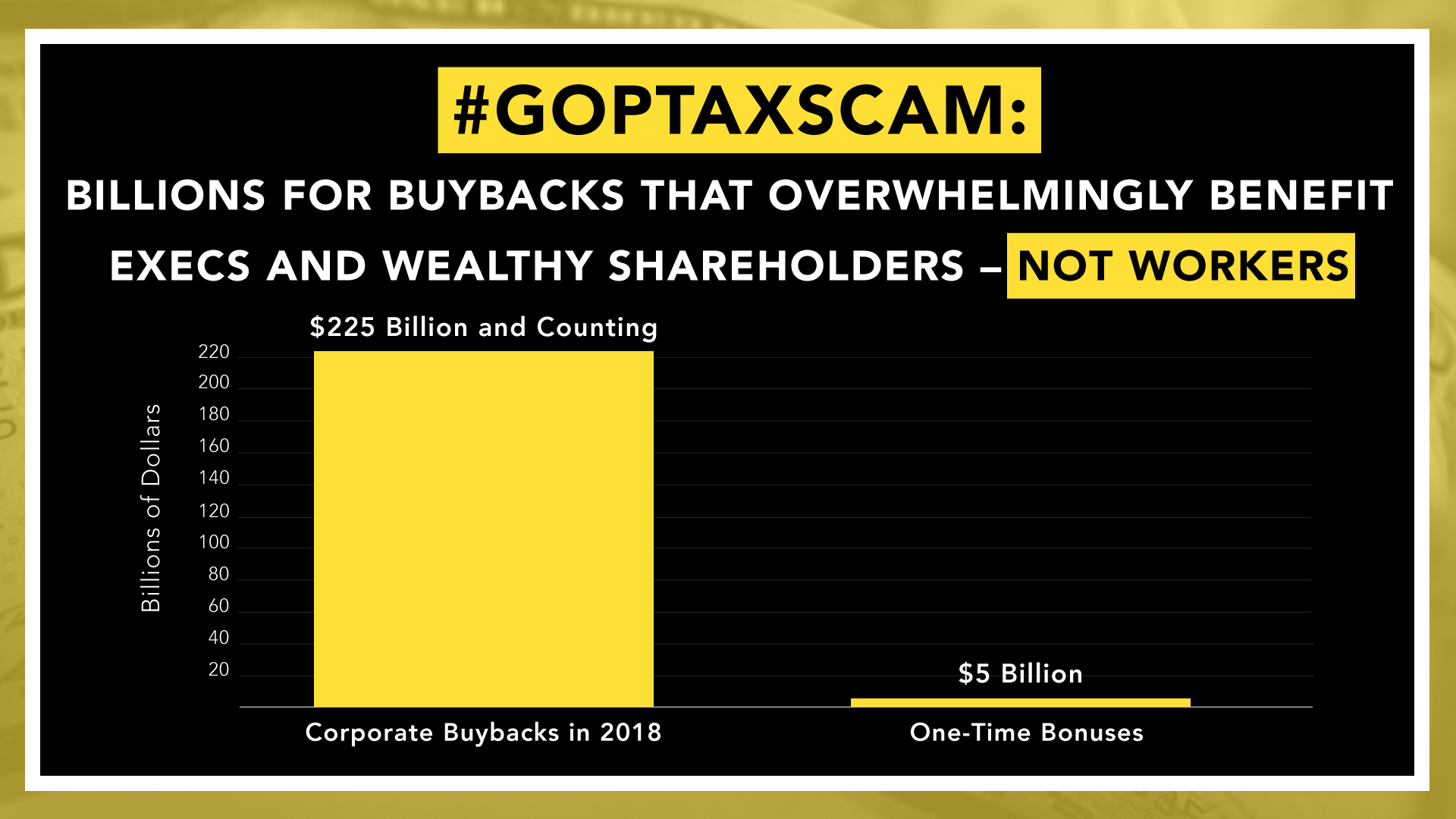

The #GOPTaxScam: Pink Slips For Thousands Of American Workers And More Than $225 Billion In Corporate Stock Buybacks Going Overwhelmingly To Top Executives And Wealthy Shareholders

In the wake of the GOP Tax Scam, major

corporations have authorized more than $225 billion in buyback schemes – money

that overwhelmingly goes into the pockets of wealthy shareholders and corporate

executives.

In fact, 84%

of stocks are owned by the top ten percent of Americans. It is clear that these

share buybacks overwhelmingly help corporate executives and wealthy

shareholders – not workers.

Corporate executives are padding their

pocketbooks with stock buybacks and laying off

American workers:

- Wells Fargo announced it will close 900 branches despite a $3.4 billion boost from the Republican tax scam. Wells Fargo also announced it will reward corporate executives and wealthy shareholders with a $22 billion share buyback program.

- Kimberly-Clark announced plans to cut up to 5,500 jobs. Kimberly-Clark also announced it will reward corporate executives and wealthy shareholders with $700-$900 million in share buybacks in 2018.

- CSX announced plans to lay off thousands of workers. CSX also announced it will reward corporate executives and wealthy shareholders with a $3.5 billion increase in their share buyback program.

- Harley-Davidson is closing a Kansas City motorcycle assembly plant, resulting in 800 workers losing jobs. Harley Davidson also announced it will reward corporate executives and wealthy shareholders with a $696 million share buyback program.

- Hess Corporation announced they will lay off hundreds of workers. Hess Corporation also announced it will reward corporate executives and wealthy shareholders with a $1 billion share buyback program.

- Cardinal Health announced it will lay off 100 workers. Cardinal Health also announced it will reward corporate executives and wealthy shareholders with a $1 billion share buyback program.

- Pfizer announced it will lay off hundreds of employees. In December, Pfizer announced it will reward corporate executives and wealthy shareholders with a $22 billion share buyback program.

- This year, Walmart will lay off thousands of workers. But days after Republicans introduced their tax plan outline in September, Walmart announced a new $20 billion share buyback plan to reward corporate executives and wealthy shareholders.

Record corporate share buybacks show that

the GOP Tax Scam overwhelmingly benefits corporate executives and wealthy

shareholders over the middle class. According to multiple analyses, corporate share

buybacks are on

track to be the “record

highest” this year.

To date, corporations have spent more than

forty-five times as much on buybacks as on one-time bonuses.

|

Corporation

|

Share Buyback Amount

Announced in 2018 (Millions)

|

Date

|

|

$25,000

|

14-Feb

|

|

|

$22,572

|

23-Jan

|

|

|

$15,000

|

13-Feb

|

|

|

$12,000

|

1-Feb

|

|

|

$10,000

|

15-Feb

|

|

|

$10,000

|

1-Feb

|

|

|

$8,590

|

1-Feb

|

|

|

$8,000

|

27-Feb

|

|

|

$7,500

|

1-Feb

|

|

|

$6,000

|

14-Feb

|

|

|

$6,000

|

31-Jan

|

|

|

$6,000

|

1-Feb

|

|

|

$5,000

|

14-Feb

|

|

|

$5,000

|

26-Jan

|

|

|

$3,500

|

12-Feb

|

|

|

$3,300

|

14-Feb

|

|

|

$3,000

|

28-Feb

|

|

|

$3,000

|

5-Jan

|

|

|

$2,844

|

27-Feb

|

|

|

$2,500

|

23-Jan

|

|

|

$2,000

|

19-Mar

|

|

|

$2,000

|

6-Mar

|

|

|

$2,000

|

6-Feb

|

|

|

$2,000

|

30-Jan

|

|

|

$2,000

|

23-Jan

|

|

|

$1,500

|

20-Feb

|

|

|

$1,500

|

14-Feb

|

|

|

$1,500

|

24-Jan

|

|

|

$1,304

|

22-Feb

|

|

|

$1,250

|

28-Feb

|

|

|

$1,163

|

26-Jan

|

|

|

$1,000

|

20-Mar

|

|

|

$1,000

|

15-Mar

|

|

|

$1,000

|

8-Mar

|

|

|

$1,000

|

7-Mar

|

|

|

$1,000

|

1-Mar

|

|

|

$1,000

|

8-Feb

|

|

|

$1,000

|

7-Feb

|

|

|

$1,000

|

5-Feb

|

|

|

$1,000

|

1-Feb

|

|

|

$1,000

|

25-Jan

|

|

|

Buybacks <$1 Billion

|

$35,624

|

|

|

TOTAL

Corporate Buybacks Authorized in 2018

|

$228.7 Billion

|

*Based on closing price on

the day share buyback was announced.

Vox: Corporate Stock Buybacks Are Booming,

Thanks To The Republican Tax Cuts. “Right after Republicans in Congress passed their

tax bill, lowering tax rates on corporations, companies delivered a very public

thank-you: a series of bonus and investment announcements. It was a major PR

opportunity for both corporate America and the GOP, meant to show that American

businesses were sharing their billions of dollars in tax cut savings with their

workers and the broader economy. But over the next few months, the real

winners from the corporate tax cut became clear — not workers and consumers,

but shareholders. Companies have boosted dividends and stock buybacks.

A stock buyback is when a company buys back its own shares from the broader

marketplace.” [Vox, 3/22/18]

CNBC: Companies Are Putting Tax Savings In

The Pockets Of Shareholders. “Share buybacks in 2018 have averaged $4.8 billion

a day, double the pace for the same period last year, according to market data

firm TrimTabs. That comes following Congress's move to slash the corporate

tax rate from the highest-in-the-world 35 percent to 21 percent.” [CNBC, 3/12/18]

Reuters: Oil majors give in to investors

with share buyback spree. “Since the beginning of year, 11 companies have promised

buybacks, with six alone in the past three weeks including Devon Energy

(DVN.N), Hess Corp (HES.N) and Noble Energy Inc (NBL.N). In all, companies have

committed to buy back about $3.6 billion worth of shares since February.”

[Reuters, 3/14/18]

David Santschi, Director Of Liquidity

Research at TrimTabs: “The feverish buyback activity suggests companies plan to use

a hefty chunk of the money they expect to save on taxes to buy back

stock." [CNBC, 3/12/18]

Ian Winer, Head of Equities at Wedbush

Securities: “‘Stock

buybacks are purely for the shareholder.” … “It is very difficult to argue

buybacks are good for the overall economy or average worker.” [CNN (Money), 3/8/18]

David Stockman, Former Reagan Budget

Director: “So

we need to focus on what's wrong with the exchange rates, what's wrong with

corporate America that constantly uses all of its cash flow for stock buybacks,

M&A deals, LBOs, leveraged recaps. They're not investing in

competitive ability for us to compete in the world market. In fact,

business cap-ex in real net terms today is 30% lower than it was in the year

2000. So that's where the problem is, and this tax cut did nothing for it. It's

a giant mistake that's going to drive up interest rates and cause, you know, huge

windfalls to Wall Street and the 1% and 10% that own the stock. But it's not

going to really address the problem.” [CNN Wolf, 3/8/18]

Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices: “Combined, buybacks and dividends could put the S&P 500 over $1 trillion for total shareholder return this year.” [Press Release, 3/21/18]

This report is available as a pdf here.