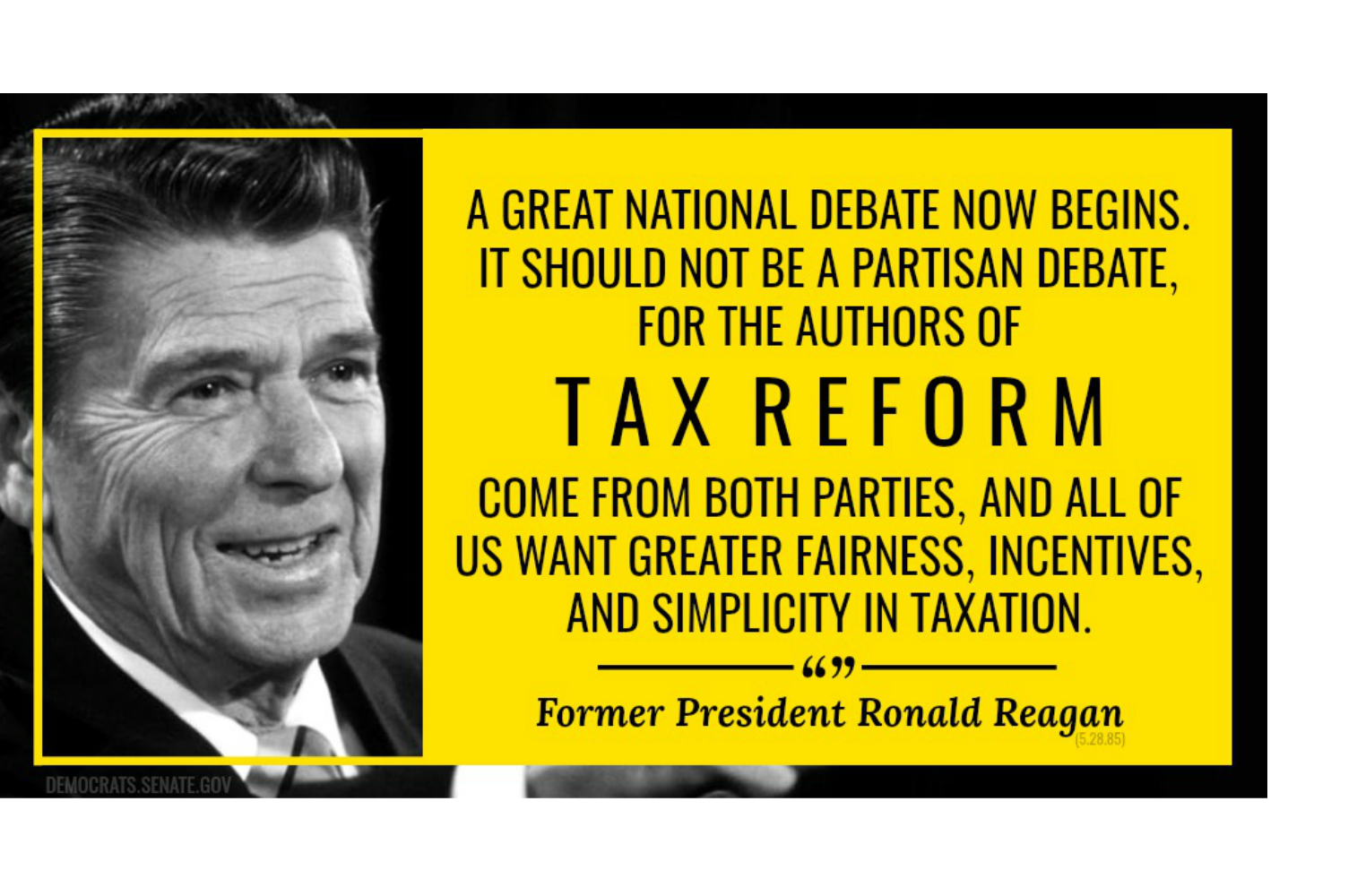

Republicans Are Making No Effort for Serious Bipartisan Tax Reform – Here’s How Comprehensive Bipartisan Tax Reform Went in 1986

THE REAGAN ADMINISTRATION SUBMITTED MULTIPLE, DETAILED POLICY PROPOSALS ON COMPREHENSIVE TAX REFORM – UNLIKE THE TRUMP ADMINISTRATION

The

Reagan Administration released multiple, detailed tax reform proposals. In

November of 1984, the Reagan Treasury Department released its first detailed,

comprehensive tax reform proposal, known as “Treasury I.” This proposal was

more than 400 pages long and included detailed revenue estimates. In May of

1985, President Reagan released a revised tax plan, referred to as “Treasury

II.” This plan was nearly 500 pages long and included detailed revenue

estimates. The Trump administration has released no such proposal.

IN THE HOUSE, LAWMAKERS SPENT 10 MONTHS WORKING TOGETHER TOWARD BIPARTISAN TAX REFORM

30 Days of Public Hearings over Six Months. According to congressional records, the House Ways and Means Committee “held 30 days of public hearings on comprehensive tax reform proposals,” between February 27 and May 16, 1985. In addition, Ways and Means subcommittees held 14 days of hearings on tax-reform related measures.

26 Days of Committee Markup over Four Months. According to congressional records, the House Ways and Means Committee “conducted 26 days of markup on the tax reform bill,” starting on September 18 and concluding with report of the tax reform bill on December 3. After rejecting a procedural motion on December 11, the House passed their version of tax reform on December 17, 1985.

IN THE SENATE, LAWMAKERS ON THE FINANCE COMMITTEE WORKED ON COMPREHENSIVE TAX REFORM FOR OVER A YEAR BEFORE A COMMITTEE VOTE

36 Days of Public Hearings over Ten Months. According to congressional records, the Senate finance committee “held 36 days of public hearings on comprehensive tax reform proposals,” between May 9, 1985 and April 21, 1986. These hearings were overwhelmingly on the Reagan comprehensive tax reform proposal or the House-passed bill. In addition, Senate Finance subcommittees held 6 days of hearings on tax-reform related measures.

17 Days of Committee Markup over Three Months. According to congressional records, the Senate Finance Committee "conducted 17 days of markup on the tax reform bill,” starting on March 19 and concluding with report of the tax reform bill, as amended, on May 6, 1986. The bill was reported unanimously, 20-0. After weeks of floor debate, the Senate approved the bill on June 26, 1986, 97-3.

FINAL ACTION – OVERWHELMING BIPARTISAN SUPPORT FOR COMPREHENSIVE TAX REFORM

More than 500 days after the first 1985 House Ways and Means Committee hearing on tax reform, the Conference committee on the Tax Reform Act began on July 17, 1986. The conferees adopted the bill on August 16, 1986. The House approved the conference report, 292-136 and the Senate adopted the bill 74-23. President Reagan signed the bill into law on October 22, 1986, more than 600 days after the first hearing.